Akhuwat Introduction

Akhuwat Foundation is a non-profit organization in Pakistan that helps poor people. It was started in 2001 by Dr. Amjad Saqib. Akhuwat is special because it gives out loans without charging any interest. The foundation’s goal is to build a community where people help each other and share money to lift up those struggling. This idea comes from Islamic values, especially Qarz-e-Hasna, which means giving loans without asking for extra money back.

As we get closer to 2024, Akhuwat Foundation keeps growing and improving its loan programs to help more people. The loans will still follow the same kind and fair rules, while also adding new ideas to solve today’s problems.

How Akhuwat Interest-Free Loans Benefit Communities

One of the most special things about the Akhuwat Foundation is that it gives loans without any interest. Unlike regular banks that charge extra money (interest) and can make it hard for people to pay back, Akhuwat’s loans are completely free of interest. This helps people focus on using the loan to make their lives better instead of worrying about paying back a lot of extra money.

Akhuwat follows the Islamic idea of Qarz-e-Hasna, which means giving money to help someone without charging interest. In Islam, this is seen as an act of kindness and charity. Akhuwat has shown that this way of lending money can be fair and work well for everyone.

1. Empowering Women Through Interest-Free Loans

A large portion of Akhuwat’s loan recipients are women. In 2024, the foundation aims to expand its support for women. Access to financial resources is essential for empowering women, especially in rural or conservative areas where they are often excluded from the economy. By offering interest-free loans, Akhuwat helps women start businesses, achieve financial independence, and contribute to their families and communities. These initiatives will continue to grow in 2024.

2. Supporting Youth Entrepreneurs

Pakistan has a significant youth population, many of whom face unemployment. Akhuwat Foundation sees young people as key to the nation’s economic future. In 2024, the foundation will emphasize youth entrepreneurship through its loan programs. By providing interest-free loans, Akhuwat gives young people the chance to launch their own businesses, creating opportunities for themselves and others.

3. Helping Small Businesses Thrive

In addition to personal loans, the Akhuwat Foundation Loan 2024 will continue to support small businesses. Small and medium enterprises (SMEs) are crucial for Pakistan’s economic growth, but they often struggle to access credit. Traditional banks require collateral and charge high interest rates, making it hard for small businesses to grow. Akhuwat fills this gap by offering interest-free loans, allowing businesses to expand without the burden of costly repayments.

How to Apply for an Akhuwat Loan Online

Follow these easy steps to apply for an Akhuwat loan online:

- Visit the Official Website: Go to the Akhuwat Foundation’s website at https://getonlineloan.site/

- Register: Sign up using your phone number. The registration process takes just 2 minutes.

- Submit Your Application: Click the “Submit” button to complete your loan application. Once approved, the loan amount will be transferred directly to your bank account.

Akhuwat Foundation offers quick funding, allowing you to receive the loan on the same day. You can also choose your preferred funding date, giving you full control of the process.

Required Documents for Akhuwat Loan Application

- Selfie: A recent, clear photo of yourself.

- Proof of Identity: CNIC or driver’s license.

- Proof of Address: Passport, rental agreement, or a recent utility bill.

- Proof of Income: Bank statements or salary slips from the last 6 months.

Akhuwat Business Loan

Applying for a business loan is simple and can be done online from your office. Akhuwat business loans are designed to meet short-term financial needs quickly. They are usually approved within hours with minimal paperwork.

Akhuwat Quality Services

Akhuwat Home Loan

Akhuwat Foundation in Pakistan offers home loans for buying, constructing, or renovating residential properties. If you’re seeking quick financial assistance, the Akhuwat Home Loan provides a seamless application process, ensuring you get the funds you need promptly. This service is perfect for those in urgent need of a loan in Pakistan.

The Akhuwat Foundation in Pakistan offers home loans for buying, building, or renovating residential properties. The application process is straightforward, ensuring a fast disbursal of funds, whether for purchasing a new home or undertaking renovations.

Akhuwat Business Loan

Akhuwat Foundation offers a range of business loans tailored to support small and medium-sized enterprises (SMEs). These loans include the Digital MSME Working Capital Loan, designed to assist businesses with their daily operations. Loan amounts range from Rs. 5 lakhs to Rs. 7 crores, with an annual review conducted every 12 months, often without the need for collateral for eligible accounts. Applicants need to provide ID, bank statements, and business details. These business loans have competitive interest rates, starting at 0.001% to 0.002% per annum, with minimal documentation requirements.

Akhuwat Foundation Marriage Loan

Akhuwat Foundation offers wedding loans designed to cover all your wedding-related expenses, ensuring your special day unfolds just as you imagined. You can borrow between PKR 5 lakh and PKR 60 lakh with flexible repayment terms ranging from 10 to 36 months. These loans are unsecured, meaning no collateral is required, and you can enjoy quick disbursal—often within 24 hours if you’re an existing customer.

Akhuwat Car Loan

Akhuwat Foundation offers car loans with interest rates starting as low as 1% per annum. With up to 100% on-road funding, they make it easier for you to purchase your dream car. The Foundation provides flexible loan tenures, allowing you to select a repayment period that best suits your financial situation. The application process is simple, requiring minimal documentation, and ensures quick loan disbursement. Akhuwat also offers pre-approved car loans for both new and used vehicles, making it easy to drive away in your dream car without hassle.

Akhuwat Personal Loans

Akhuwat Foundation offers personal loans of up to Rs. 25 lakhs. The maximum loan amount you can receive depends on factors like your income, debt-to-income ratio, credit score, and employment status. The eligible age range for these loans is 24 to 60 years.

How to Apply for an Akhuwat Loan in 2024

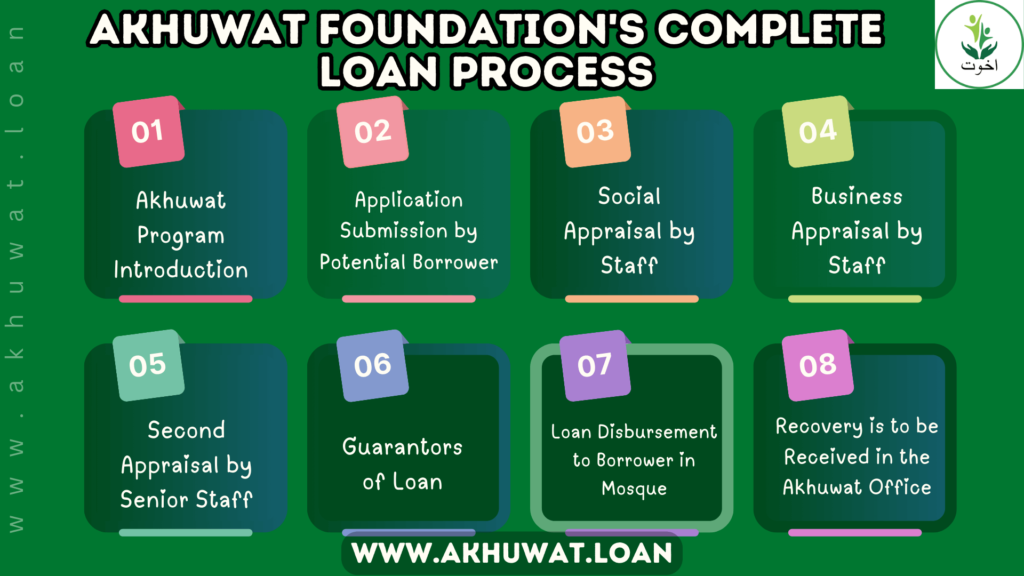

Akhuwat Foundation makes the loan application process simple and easy to follow. Unlike traditional banks, Akhuwat doesn’t require a lot of paperwork or collateral, making it accessible to everyone. Here’s how the process works for 2024:

Step 1: Check Eligibility

To qualify for an Akhuwat loan, you must:

- Be a Pakistani citizen.

- Come from a low-income household.

- Have a valid reason for the loan, such as starting a business, education, or health expenses.

Akhuwat’s loan officers will review your background and financial needs to make sure the loan goes to those who need it most.

Step 2: Complete the Application

Fill out a simple loan application form with details about your financial situation and the purpose of the loan. You can submit the form online through Akhuwat’s website or in person at one of their centers across Pakistan.

Step 3: Approval and Loan Disbursement

Once your application is approved, the loan amount will be given directly to you. Loans range from PKR 10,000 to PKR 100,000, depending on your needs. The process is clear, with no middlemen involved.

Step 4: Easy Repayment

Repaying the loan is straightforward. Borrowers pay back in small, affordable installments over time. Since Akhuwat doesn’t charge interest, you only repay the exact loan amount, making it easier to manage. Timely repayments help Akhuwat provide more loans to others in need.

Akhuwat Penalty Policy

- No Late Payment Penalties

We understand that unexpected events can impact your ability to make timely payments. Therefore, we do not impose any penalties for late payments. We are committed to working with you to find solutions for your financial situation. - No Prepayment Penalties

If you can repay your loan earlier than planned, we encourage you to do so. Our loans do not have prepayment penalties, allowing you to save on interest and pay off your debt sooner without incurring additional charges. - Flexible Repayment Options

We offer flexible repayment options to meet your financial needs. Whether you need to adjust your payment schedule or extend your loan term, we are here to assist you without any penalties. - No Fees and No Hidden Charges

We prioritize transparency and honesty in all our dealings. Our loan agreements come with no hidden charges, fees, or surprise costs. From the start, you will know exactly what to expect. - Low Interest Rate

Our loans are offered at a competitive interest rate of just 1%. This low rate helps you manage your repayments comfortably without undue financial strain.

Disclaimer:

The information about Akhuwat Foundation’s loan services is for general informational purposes only. While we strive to keep the details accurate and up-to-date, loan terms, eligibility requirements, and application processes may change. Please verify the latest information and conditions directly with the Akhuwat Foundation before applying for any loan. We are not responsible for any inaccuracies or changes in the loan offerings.

Final Thoughts

The Akhuwat Foundation Loan 2024 serves as a lifeline for many Pakistanis facing financial struggles. By offering interest-free loans, Akhuwat opens doors for people who have been left out of traditional banking services. With a focus on empowering women, supporting youth, and helping small businesses, the foundation is giving individuals the chance to improve their lives and contribute to the economy. As Akhuwat continues to grow, it remains dedicated to its mission of building a fairer society, one loan at a time.

- 1. Who can apply for an Akhuwat loan?

Anyone who is a Pakistani citizen and belongs to a low-income household can apply for an Akhuwat loan. The loans are available for purposes like starting a business, education, or health expenses. - 2. Are Akhuwat loans really interest-free?

Yes, all Akhuwat loans are completely interest-free. You only need to repay the exact loan amount without any extra charges. - 3. How much can I borrow from Akhuwat?

Akhuwat loans typically range from PKR 10,000 to PKR 100,000, depending on the borrower’s needs and financial situation. - 4. How do I apply for a loan?

You can apply online through the Akhuwat website or visit one of their centers across Pakistan to submit your loan application. - 5. How do I repay the loan?

Loan repayment is made in small, affordable installments over a set period. Since there’s no interest, you only repay the amount you borrowed.